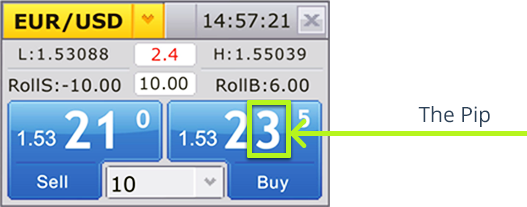

People trade currencies all the time, but how can currency be an investment? Here's a simple example. Imagine that you took a trip from the United States to Europe in 2002. For the trip, you changed your US dollars into euros. At the end of a trip, you typically would change any extra euros back into US dollars. But what if you didn't?

In 2002, one euro was worth about 90 US cents ($0.90). Say that you decided to hold on to 500 euros, and left them sitting in your desk drawer for 5 years. In 2007, you took your euros to the bank and sold them for a 2007 price of $1.40. Since you bought the euros for $0.90 and sold them for $1.40, you made a $0.50 profit per euro. You would have made $250 just because you held on to those euros and had bought and sold at the right time. That's a 55% return in 5 years.

What is Forex? And Why Trade It?

You may not know it, but forex is actually one of the largest markets in the world, with over $4 trillion in average daily volume transacted.

So, if forex is so big, why have so few people heard of it?

The simple answer is you have probably used the forex market before, either directly or indirectly. Any time you take a trip to another country and exchange money, you just made a forex trade. Whenever you buy something in a shop that was made in another country, you just made a forex trade. You paid in your own currency and the manufacturer was paid in a different currency.

...you have probably already used the forex market before - directly or indirectly.

Mr. Bernard Lonsdale